Summer Potpourri

Rather than focus on a single issue this month, we are going to briefly touch on a few:

Inflation

We wrote a bit about inflation at the end of the first quarter. It seems it was a timely discussion given all the handwringing regarding inflation lately. The year-over-year number most recently reported reflected an increase the likes of which we have not experienced in quite a while. While we do not like higher prices any more than the next person, it may be a bit premature to begin panicking about a return to 70’s style inflation. Remember, a year ago, we were in a pandemic-forced lockdown. Demand all but disappeared (except for toilet paper). Fast forward to today and there is a tremendous uptick in demand as states have been reopening. While the demand itself would push prices up given normal supply levels, current supply levels are low due to many transient issues - the Suez Canal block, grid issues in Texas, the inability to get manufacturing up to speed, challenges filling open positions, etc. Each of these challenges is/was temporary, so there is a good chance that the inflationary uptick is simply a blip. Of course, it may be a harbinger of things to come. There are brilliant arguments on both sides. We are awaiting more data before we pick a side in this fight.

Bitcoin

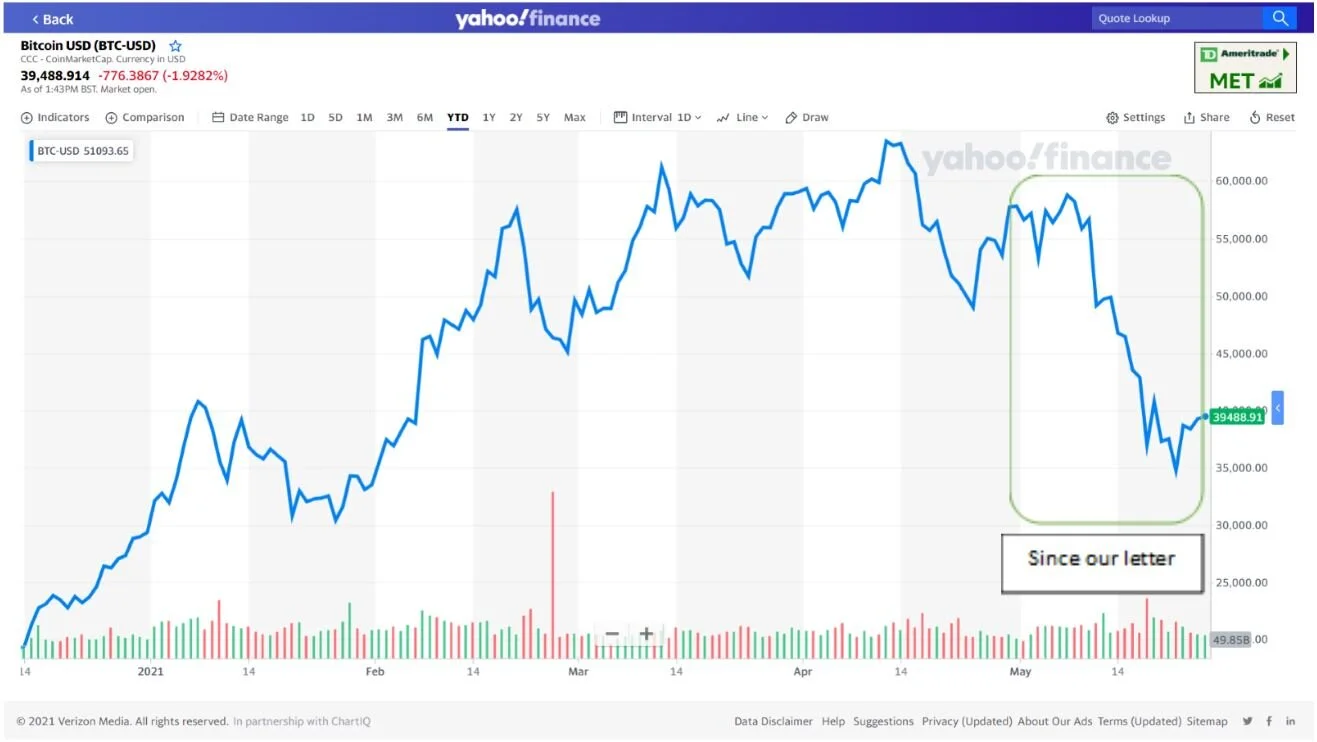

It seems that our May topic – a brief primer on cryptocurrencies – may have been timely as well. One point we made was: “While it is easy to think about the money that one could make, a big part of investing has to do with understanding the downside risks”. Seems a bit prescient as we look at the action in the price of Bitcoin since the beginning of the year and since the date of our letter:

While the year-to-date performance is still impressive, for those keeping score at home, Bitcoin fell from a little over $63k in mid-April to a little under $35k in mid-May. THAT is volatility!

Tax Changes

We have threatened to write about changes to the tax code. Fortunately, our representatives in DC are having difficulty getting anything done. To that end, any discussion would be pure speculation at this point. While some of the changes that have been floated seem somewhat draconian in nature, it is likely that they simply represent the starting point in what is anticipated to be a somewhat lively negotiation. The good thing is that as time continues to march on, it becomes less and less likely that any changes will be retroactive. However, President Biden’s recently proposed $6 trillion budget is paid for, in part, by changes in the capital gains tax that are assumed to have begun in late April. Per the Wall Street Journal, a White House official claimed that the effective date would be designed with Congress to prevent taxpayers from taking advantage of any gap before the tax increase started. Fortunately, there is considerable pushback to making any negative changes retroactive. Importantly, that pushback is coming from both parties. We will continue to monitor the situation and will discuss any changes – and how to address them – once there is greater clarity.

Taxes – Part II

The filing deadlines have passed – yippee! However, now is the time to start thinking about this year’s taxes. If you had a rude surprise in 2020, it may be even ruder in 2021. Even if 2020 turned out to be a pleasant surprise from a tax perspective, which may have been the case given lower earnings and checks from the government, 2021 may be much different due to higher earnings, changes in tax rates, etc. Taxes in 2021 can be even more of an issue if you plan on selling real estate, a business, etc. There are a variety of things we may be able to do to help you blunt the impact of higher taxes in 2021, but most, if not all, require us to be proactive and take action before the taxable event occurs. If there is something on the horizon that is of concern, let us know so we can help walk you through the various options that might be available to you. Worst case – you do nothing. Best case, we are able to put together winning strategy for you.

Closing

As we try to counsel, the things that are truly important in life have very little to do with the topics of our regular missives. As summer kicks off, we know many of you will be traveling – some of you for the first time in over a year. Given the challenges of the last year for many, relish the time you can spend with those you care about and enjoy the hugs from those you may not have had a chance to hug since early 2020. Have a wonderful summer!