The Digital Currency Phenomenon

If you have not heard of Bitcoin, Ethereum and Coinbase, among others, you have probably not tuned into the news much (good job!). Some of you are very familiar with these digital currencies and exchanges, but many of you are not. We’ll take a shallow dive into the topic to hopefully provide a little insight.

The Basics

First, let’s start with the basics. What exactly are Bitcoin and Ethereum and how do they relate to Coinbase?

Bitcoin and Ethereum are examples of cryptocurrencies. For the record, there are many more – you may have heard references to XRP and Dogecoin, to name a couple. Given the sheer number of cryptocurrencies, it is easy to go down a rabbit hole very quickly. We’ll try to avoid that and stay at a relatively high level.

So, what exactly is a cryptocurrency? Formally, a cryptocurrency is a digital currency that is secured by cryptography.

Clear as mud, right?

Let’s break it down a bit. First, we have the concept of a “digital currency”. As with all things digital, none of this currency is tangible. There are no “coins” or “tokens” or “dollars” that you can stuff in a mattress. The currencies are essentially computer files that you store in a virtual “wallet” – basically a USB drive with encryption or an online account at a custodian that deals specifically with cryptocurrencies. Each wallet has a private “key” to secure transactions (basically, a password).

The second concept deals with the fact that the currency is secured by cryptography. In this case, the cryptography uses blockchain technology. Blockchain is a type of database that stores data in blocks that are then chained together. The data is immutable (entries can’t be reversed), and it is available for anyone to review. With these attributes, no single person or group has control and there is full transparency of all activity. Despite that public record, the holder of each coin remains anonymous, rather transactions identify wallets which, by their nature, are anonymous.

In summation, cryptocurrencies are internet-based mediums of exchange that are outside the control of governments and/or central banks and that rely on cryptography (in the form of blockchain technology) to conduct secure financial transactions. Each transaction is secured by a user’s private key and becomes a new link in the chain.

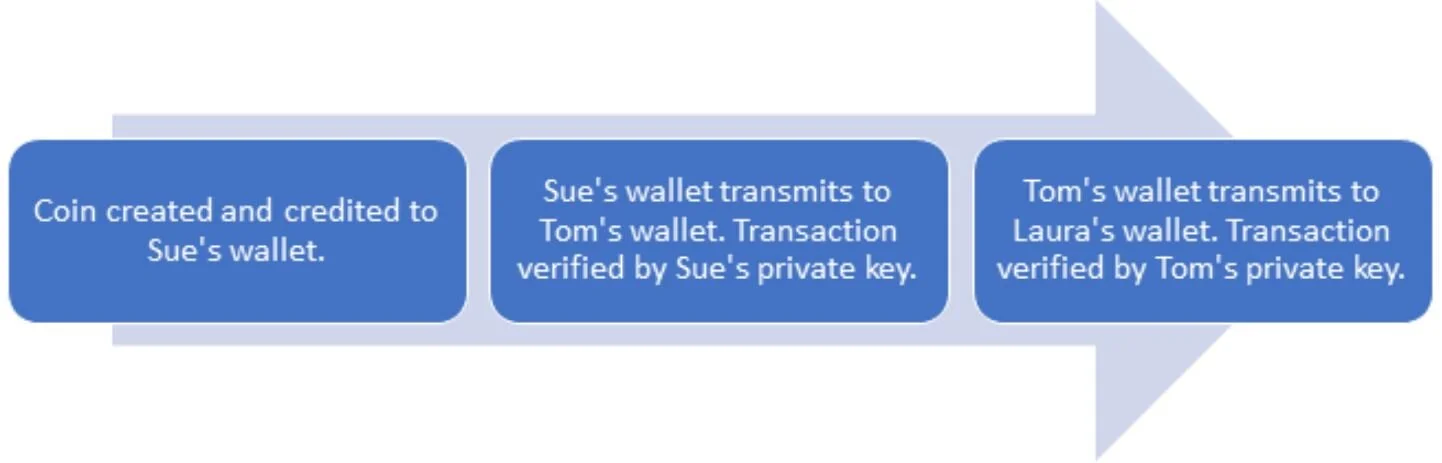

Perhaps a simple example will help with the concept. Let’s take three people – Sue, Tom and Laura. Assume Sue has 1 bitcoin that was just created. Tom has merchandise Sue wants that costs 1 bitcoin, so Sue pays Tom with her coin and Tom delivers the merchandise. That transaction is recorded and becomes a permanent link on the transaction chain for that coin. Now assume that Tom pays Laura for something using that same coin. The chain is now extended by one link reflecting that transaction. So, when anyone wants to see the history of that coin, they will see something to the effect of this:

Now, this is very simple in nature. Remember, names aren’t used, so there is considerably more privacy than this example suggests. The point is that there is a ledger of all transactions, which helps to ensure the integrity of the coin and the transactions.

The one thing we haven’t touched on in this discussion is Coinbase. While Bitcoin and Ethereum are examples of “currencies”, Coinbase is an “exchange” where one can trade and store those currencies (Coinbase offers a “wallet” – or in normal language, an account). To bring equate it to the stock market, Bitcoin, Ethereum and the other currencies are stocks and Coinbase is similar to a stock exchange; however, it is an exchange that will also let you set up an account and store your holdings there (a “virtual wallet”).

Recent History

The cryptocurrency frenzy started with Bitcoin, so let’s dig into the recent history and how things have evolved.

In 2017, Bitcoin (BTC) caught the attention of the public as it made a move from around $1,000 at the start of the year to just around $20,000 in mid-December of the year. At the time, there was little support for BTC, it was difficult to obtain, the demand was from retail “get rich quick” investors, there was little regulatory framework, and the list goes on. Put simply, there was no foundation. As such, late investors (perhaps “speculators” is a better term) learned that what goes up quickly can also come down quickly. To that end, by December 2018, BTC was trading back around $3,000. A great return for those who owned it at $1,000 in January 2017. Not so great for the multitude that bought it at higher prices.

Here’s a snapshot of the ride:

The total supply of BTC is – and will be - limited to 21 million bitcoins. So, pricing becomes a true supply and demand issue, with fixed supply and variable demand. As long as demand is high, the price will increase. Of course, the opposite is also true.

Bottom line – BTC is really the embodiment of creating value from nothing. If there is utilization and trust in the system, there is value. However, once either disappears, so does the value.

Going back to 2017, there was little utilization (except for black market transactions) and, as such, little trust. At the time, it was simply a FOMO trade – Fear of Missing Out. Those who rushed in probably wish they hadn’t, but dreams of instant riches are often hard to resist.

That brings us to today. Here’s a chart of the action in BTC since the start of 2021:

There are two points I’d like to make with respect to this chart:

The move for the year is impressive – rising from about $23k to a bit over $53k. If we were to back up to the start of 2020, the move has been stratospheric.

While it is easy to think about the money that one could make, a big part of investing has to do with understanding the downside risks. As we saw in 2017 and 2018, there was considerable downside. Even in 2021, we see some significant downward moves – in February, there was a drop from $57k to $45k over the course of a week (that’s 21%) and in April, there was a drop from $63k to $49k (+/- 22%).

According to a December 2020 report from Galaxy Fund Management there are some fundamental differences between BTC (and other cryptocurrencies) today and BTC in 2017:

There is less retail speculation and more institutional participation. Large hedge funds, insurance firms and other Wall Street firms have made – or plan to make – significant purchases. For example, Guggenheim Partners has filed to allow up to 10% of its assets to be invested in BTC, with other cryptocurrencies soon to follow.

Liquidity and transparency have improved since 2017. In 2017, daily liquidity hovered around $1-3 billion. In late 2020, that same metric was in the $6-10 billion range (source: Galaxy Digital Research).

The regulatory environment has evolved. The SEC and the Office of the Comptroller of the Currency (OCC) have both clarified their stances and provided guidance on BTC and Ethereum, strengthening both as investable assets.

Institutional service providers have gotten involved. Unlike 2017 when buying and holding BTC was somewhat difficult, today there are institutional custodians and exchanges involved – the CME, Fidelity and Bakkt, to name a few. These entities are subject to regulatory oversight by groups such as the SEC, FINRA, CFTC, etc. Additionally, they are audited by Big Four audit firms. This institutionalization reduces some of the risk associated with the investment.

The adoption story has changed. Today, companies are using BTC as a substitute for cash. Notably, MicroStrategy (NASDAQ: MSTR) and Square (NASDAQ: SQ) have made in excess of $500 million in purchases to simply have BTC on their balance sheets. Tesla (NASDAQ: TSLA) has also made a sizable move into Bitcoin. Companies like PayPal are providing a mechanism to use BTC for purchases and payments.

Clearly, there is a much more significant foundation today than in 2017.

Of course, there are also a few fundamental concerns:

One of the important aspects of a currency is that it can serve as a store of value. As noted above, the price of Bitcoin (and other cryptocurrencies, for that matter) has been extremely volatile. While the trend has been up of late, that can change – and quickly. This year alone, there have been two times where the value has declined by more than 20%. That type of volatility does not provide the same sense of security one might get from holding dollars, for example.

The central banks are still working on how – and if – they are going to regulate cryptocurrencies. Guidance has come out on taxation, and there will likely be more to follow.

Given the virtual nature of cryptocurrencies, fraud is a very real issue. This point was hammered home very recently with a Turkish exchange being accused of defrauding some 391,000 investors to the tune of $2 billion.

Central banks and governments continue to study the space and may enact regulations that can have a significant impact on the perceived value.

Investing in Cryptocurrencies

Which now brings us to the crux of our discussion. Should you invest and, if so, how can you do it?

Before you think about investing outright, you should know that you probably already have some exposure. Due to the holdings in our portfolios, we own positions in TSLA and Paypal, to name a couple. As noted above, both companies have exposure to Bitcoin, giving you indirect exposure through these companies.

If you are still considering a direct investment, it is important to note that as we discussed above, BTC and other cryptocurrencies represent supply/demand pricing in its purist form. There is no intrinsic value in a cryptocurrency – it does not generate a cash stream, and it really does not “exist” in a tangible sense. There is only value to the extent people perceive there to be value. To that end, we will not opine as to whether or not you should invest, particularly at current price levels. However, investing in BTC and other digital currencies is gaining support from asset allocators, with many recommending a 0.5% to 2% allocation. Of course, many still advise no allocation at all, and some advise a much larger allocation. Regardless, you should keep in mind that this is a speculative group of assets with tremendous price volatility. While the possibility for gains may seem attractive, the possibility for significant losses is very real.

So, if you are still interested, how can you invest?

Direct: There are “exchanges” that will let you purchase Bitcoin and other digital currencies directly such as Coinbase and Bitstamp. Over time, it is likely that the traditional brokerage firms will make buying easier, but for now, direct investing can be a challenging since an account would need to be established with the digital exchange and funds need to be transferred to the exchange prior to any purchase.

General Retail Vehicles: There are currently a number of applications by ETF (exchange traded fund) providers to create products for US distribution (there are some in Canada). Currently the only option is an investment in the Grayscale Bitcoin Trust (GBTC), Grayscale Ethereum Trust (ETH or ETHE) or one of Grayscale’s other funds. Unfortunately, these vehicles charge very high management fees (2%+). Also, in the past, GBTC traded at a significant premium (in other words, you would pay more than $1 to buy $1 worth of Bitcoin), but it is currently trading at a discount and has been since early March.

Accredited Investors: For accredited investors (you know who you are), there are fund vehicles that may be interesting options. These vehicles do not charge a premium, rely on institutional custodians, are audited and charge more reasonable fees than GBTC (1-1.25%, depending on size of investment). Better yet, these vehicles may be able to be held in your existing account.

If investing in BTC (or other digital currencies) is something of interest, please reach out, and we will be happy to talk through the pros and cons as well as the options available to you. For the vast majority of you, if you want to invest, waiting until there are ETF options will be the best course of action; however, there are some that might like to “go direct” and/or explore one of the other available alternatives.