Inflation - Should You Be Concerned?

We are one quarter into 2021, and we are seeing some real change. The Covid “freeze” appears to be thawing to some extent with about 30% of the U.S. population having received at least one dose of the vaccine. That figure should increase rapidly over the next month or two as vaccine availability increases and age restrictions are lifted. Having spoken with many of you, our readership is well-represented in that figure. More importantly, many of you have increased confidence in returning to a “normal” life and are beginning to do so, albeit slowly.

To help those who may still be suffering economically from the pandemic, the powers that be passed a very large support package early in the year - $1.9 trillion. There are plenty arguments for and against the spending – we will not address those. What we do want to address, however, is the perception that inflation – or even hyperinflation – is a risk. More importantly, should you be concerned?

Before we delve into that, let’s briefly review the quarter.

1Q 2021 Review

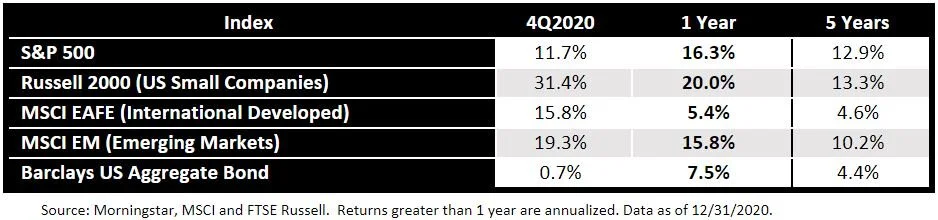

The following chart reflects the performance of a variety of indexes during the last quarter and for longer periods as well.

During the first quarter, the various stock markets powered ahead, with small companies leading the charge. International developed and emerging markets lagged, but still did well. Bonds, on the other hand, lost as a result of rising interest rates.

Small company stocks tend to do well as economic activity increases, and that is reflected in the figures above. Similarly, interest rates tend to increase a bit as the economy improves. That is also reflected in the figures above. Despite the current struggles being experienced by bonds, as everyone saw last year, they can play a very important part in a portfolio, particularly during times when stocks are facing headwinds.

The real story of the chart, though, is the second column – the one-year returns. Last year, the big market decline due to Covid occurred in March, with the lows being registered before the end of the quarter. Things began improving – at least in the markets – shortly thereafter. Since the current one-year returns no longer include the first quarter of 2020, they look pretty amazing. Just to remind you, here’s what the same chart looked like last quarter:

The one-year figures were attractive at of the end of the fourth quarter, but they pale in comparison to the current chart. We have warned about the risk of relying on rolling performance numbers and, more specifically, the risk of focusing on short-term performance. This is perhaps one of the most compelling examples of how quickly and dramatically the numbers can change.

We tend to focus on longer-term performance. As you can see from the charts above, the five-year numbers look better after the first quarter than they did after the fourth quarter (with bonds being the notable exception). However, the change is much more modest.

Is Inflation a Concern?

The amount Congress spent to combat Covid combined with additional spending requests from Biden are causing a bit of pause even for drunken sailors (no offense to those of you who may, in fact, be drunken sailors). In addition to the $1.9 trillion passed for Covid relief earlier this year, there is at least another $2 trillion on tap for a variety of infrastructure and other projects. While the latter bill has yet to be passed, suffice to say that there would be a lot of money sloshing around our economy.

With the increased liquidity, there are some very real concerns about inflation. Some point to the recent rise in bond yields as proof positive that there is inflation and that it will run out of control. Others believe that while there will be some inflation, it will be short-lived.

The argument for out-of-control inflation is relatively simple. Essentially, it goes like this: inflation is defined as too many dollars chasing too few goods. We are going to have a lot more dollars chasing the same number of goods, so there you have it.

The argument for a more short-lived variety of inflation is a bit more nuanced. That argument acknowledges that there will be a near-term impact from the increase in dollars. It also understands that year-over-year readings in the near future will look particularly inflationary due to the fact that economic activity and pricing fell off the proverbial cliff in 2020 due to Covid. So the rebounds in 2021 may appear excessive, providing a “scary” headline number. However, it counters that there are other forces that will blunt the impact of inflation over time.

For example, this argument looks at the current level of unemployment as a counterbalance to inflationary concerns. As the workforce is redeployed, it will allow for greater production to meet the greater demand, blunting some of the impact of “more dollars chasing fewer goods”. This outcome will also be realized if companies continue to automate, which happened at a dizzying pace due to Covid. Automation can result in significant productivity increases, which can have a similar, if not larger, impact as a decrease in unemployment on the ability to increase the supply of goods.

Additionally, demographics can serve to lessen the impact of inflation. With the average age of the population rising, the number of retirees is increasing. Studies have shown that retirees tend to become more frugal over time, which is deflationary in nature, and, importantly, support politicians who manage inflation closely since nest eggs and overall lifestyles can be severely impacted by inflation.

It is too early to tell which of the foregoing arguments is more accurate, and we will not attempt to guess, but we will provide two closing thoughts on this subject.

First, gold is often touted as a wonderful hedge against inflation. The following chart shows the performance of gold in 2021 (the exchange traded fund, GLD, is used as a proxy):

As you can see, gold is down a bit under 10% for the year. While inflation may be a fear, it certainly is not being reflected here.

The final point has to do with the following chart:

As you can see, over time, owning stocks is about the best defense against inflation, with inflation averaging a little under 3% over the period shown and large company stocks returning in excess of 10% over that same period (with small company stocks doing even better). The logic behind that is pretty simple – as prices increase, companies pass along those increases to their customers. There may be a bit of a lag where corporate profits dip while the companies readjust; however, they do readjust. On the other hand, while bonds can outperform inflation, once a bond is issued, the interest rate is set, so if inflation picks up, there is little to nothing that can be done to enhance the prospects of existing bonds.

Regardless of how conservative you might be, your portfolio has an allocation to stocks. The implication being that you also have an allocation that can help protect against inflation over time – whether it is a real threat or simply a transitory issue.

Our Positioning

As we have discussed, our portfolios are effectively split into two components – a long-term “buy and hold” portfolio, which represents about 50% of the total portfolio and a more opportunistic “trading” portfolio, representing the other 50%.

There are two things that make our approach a bit unique. First, for those concerned about the market, our long-term “buy and hold” portfolio can utilize investments that provide a measure of automatic downside protection. In other words, these investments can potentially protect the value of the account during difficult times in the market (although the downside protection may come at the cost of upside participation). For those using them, these investments have proven to be quite useful in dampening the volatility during the tumultuous markets we have experienced this year.

The second thing that makes us unique is our use of both passive and opportunistic approaches. For the opportunistic portion of the portfolio, we work closely with an institutional investment management firm to ensure that we – and by extension you – have access to the same data and insights relied upon by many of the top investment management firms around the world. This is a data-driven process – we do not let our personal feelings about the market contradict the data. We rely on 6 primary indicators that help derive our top-down decision on how much to allocate to stocks vs. bonds:

Relative Strength: measures whether stocks or bonds are more attractive

Market Breadth: looks at whether many or just a few stocks are improving

OECD Leading Indicator: identifies turning points in business cycles

PMI Breadth: focuses on whether manufacturing activity is expanding or contracting

Baltic Exchange Dry Index: studies shipping rates

Central Bank Policy: examines the activity of central banks around the world with respect to rates and other monetary policy.

Based on the indicators, our opportunistic portfolio began overweighting stocks relative to bonds and established a larger position in smaller company stocks in late 2020, which has proven prescient. As we enter the second quarter, we are maintaining an overweight to stocks, with a tilt towards small company stocks, value-oriented stocks and stocks of U.S. companies in general. This part of the portfolio tends to trade more frequently, so changes may be made in the upcoming months as the overall tone of the market continues to change.

Closing

There are a lot of things we did not touch upon in this letter, tax proposals being one of the most significant. You can expect to read more about that topic next month as Washington tries to figure out how it is going to pay for all the spending that has been proposed (or passed). With respect to taxes, though, if you were not aware, the tax deadline has been extended to May 17th. For those of you who still need to make IRA contributions for 2020, that deadline has also been extended. If you need assistance with that, please let us know – we are here to help.

Have a wonderful April!