Market Update

Large market moves like the ones we have been experiencing can be scary. For some, they are even panic inducing. As long-time readers know, we believe that maintaining a degree of perspective can help quell feelings of panic. To that end, we want to share some perspective from a long-time stock market strategist that we know, Jeff Saut.

Jeff has some 40-50 years’ experience as an analyst and strategist. This morning, Jeff sent out an update with a quote from someone that he has followed for quite some time (yes, even the best strategists like to see what others are saying – it helps one keep an open mind):

We’ve had a few panic declines in the markets over my stint in this biz in the last 48 years. Panics are particularly interesting for one reason. The reason is this: The surest action in the markets is the recovery following the panic. It is almost a rule (If anything in the markets can be called a rule) following a panic, there will be an advance that will recover roughly one-half of the price lost during the panic. This applies in individual stocks, to commodities, to indices, and to the averages.

People forget that what prolongs a bull market, any kind of bull market, is the phenomenon known as the correction. A rocket-rise type of bull market, one with little or no correction action, always ends up as a short-term bull market. Thus, seasoned investors tend to welcome corrective action during bull markets. They know that the more corrections and the more often a bull market is held back, the bigger that bull market will be – and ultimately the higher that the bull market is fated to climb.

... An old stock market wag.

Jeff’s note also included the following from the well-respected Lowry Research Corporation:

In summary, despite its speed and severity, the current market pullback has antecedents in similar market declines over the course of the current bull market. Most importantly, though, there was little evidence of a major top prior to the current sell-off or prior to any of these earlier sharp market declines. Thus, once this pullback runs its course, the probabilities should clearly favor a resumption of the bull market with prospects for additional new all-time highs in the following months.

Declines such as this are not fun, but they are a normal and necessary part of the market cycle. While anything can happen, the fact that this decline began at a time when the economy was generally in good shape and there was little evidence of a major market top suggests that this is more of a cyclical (i.e., short-term) condition as opposed to the start of a long-term (secular) bear market.

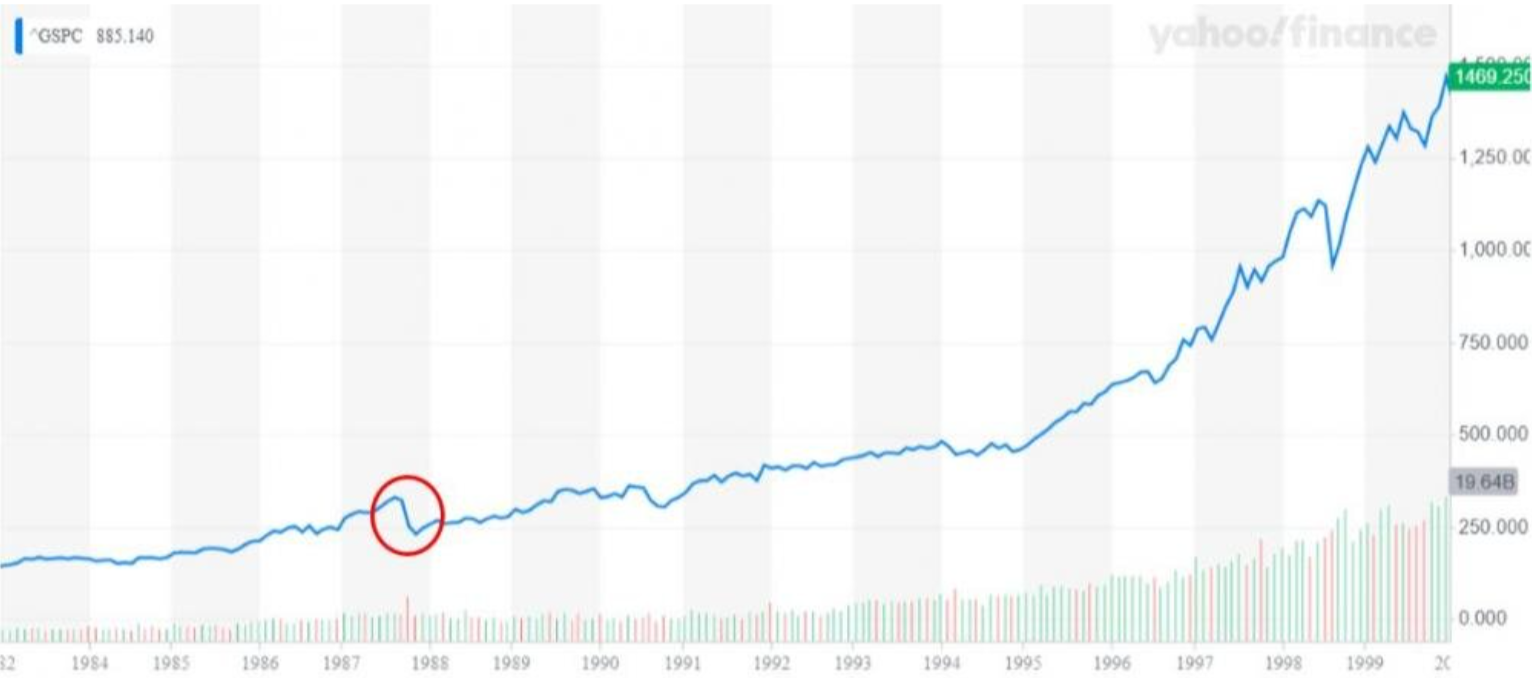

The largest one-day drop in the markets occurred on October 19, 1987, a day commonly referred to as Black Monday. Interestingly, that drop occurred during a secular bull market, which also defines the current state of the market. While the facts, circumstances and hopefully magnitude of that decline are different than the current decline, a couple charts may be helpful to provide some additional perspective.

This first chart shows the actual decline and then the subsequent recovery. As is typically the case, the decline was swift and the ensuing recovery was slow and steady, with new highs being registered by October 1989. The takeaway is that new highs were attained (as they always are), but it takes some time. This is exactly the reason we advise that any funds you know you’ll need within the next five years be invested in cash/equivalents, bonds, etc. Investing in the market is a long-term proposition.

This next chart shows the events of October 1989 in the context of the longer-term. The circle shows the Black Monday decline.

While the decline is noticeable, in the context of the longer-term bull market, it was relatively inconsequential. Again, this is why we stress that:

Investing in the stock market should be for long-term investments only, and

Your portfolio is designed with the expectation that we will experience both bull and bear markets.

If you find yourself needing some reassurance, please call – that’s why we are here. Like all declines in the past, we have no doubt that this shall pass and that we will see higher highs in the future.