COVID-19 and the Markets

We typically want our mid-quarter pieces to focus on something other than the markets. Last month, we deviated from that intent to briefly address the Coronavirus, now known as COVID-19, which was beginning to impact the markets. We did not originally plan to focus on that subject, or the markets, this month; however, events of the last week have forced us to change our plans including sending this out prior to the end of the month.

COVID-19

There are far more reputable sources to discuss the ins and outs of COVID-19 than us. However, there are a couple issues we want to highlight.

Pandemic

Just a few weeks ago, many believed that the spread of COVID-19 was (or could be) somewhat contained. However, new cases are occurring in a few disparate locations around the world, some without an obvious link to a known case. As such, more and more experts are concerned that we may be looking at a pandemic.

Pandemic is a scary word. However, it simply means that a disease is prevalent over an entire country or the world. It is important to understand that it does not mean that the disease is particularly deadly. Thus, the term simply relates to “spread”.

Our last pandemic was the swine flu (H1N1) in 2009-2010. According to data from the Center for Infectious Disease Research and Policy, it is estimated that between 11 and 21% of the global population contracted the illness. The Centers for Disease Control and Prevention (CDC) estimates the fatality rate ranged from 0.01 – 0.08%.

While it can be argued that a single death is too many, the above statistics show that pandemic doesn’t necessarily equate to mass fatalities. It is believed that simply following good hygiene practices (washing hands, covering mouth before coughing, etc.) may blunt the spread of the current virus. Importantly, trials are already underway for a vaccine only 3 months into this scare. For reference, when we had the SARS scare in the early 2000’s, it took about 20 months before a drug was being tested. Also, it appears that the advent in new cases in China may have peaked. We need longer to confirm that that is truly the case, but it is a potentially positive development as well.

More importantly, the risk in the US may be minor – relatively speaking. This flu season, the US has experienced 15 million cases of the flu and 8,200 deaths. At this point, there are only 15 reported cases of COVID-19 in the US. While that can and probably will change, keeping things in perspective is important.

The takeaway is that “panic” is easy, but unwarranted at this point.

Economy

There will be economic impacts from the spread of COVID-19. The economic tussle between the US and China the last couple years convinced many companies that they needed to diversify manufacturing and sourcing of materials to places beyond China. Some progress has been made, but China is still a critical component in global trade. With the epicenter of the virus being China, many companies have already warned of supply disruption and a related impact on revenues and earnings. At this point, many anticipate that this impact should be transitory and delay, rather than eliminate, activity. In other words, there may be a lull in activity, but many experts believe that will simply result in a stronger than normal period to follow.

Knowing that there will be an impact and determining the magnitude of that impact – both domestically and globally – are two different things. Domestically, we have been blessed by a strong economy, and the consumer is on solid footing. Moreover, we are also less exposed to the rest of the world and are positioned well to ride out any storm because we tend to be reliant on US workers and their spending (again, the consumer).

Despite all the political jawboning, the US healthcare system is among the best in the world and the CDC is one of the most, if not the most, respected health agencies in the world. Again, barring a major change, if this is like similar events in the past, demand will simply be shifted. If that is the case, one would expect robust activity afterwards as consumers “catch up” on their pent-up demand.

The Market

So, all of that is fine and dandy, but the market does what it wants, and it has clearly thrown a tantrum over the course of the last week. We have had a few large down days with little to no respite.

Clearly, nobody enjoys when the markets decline. However, market declines are a normal part of the process and are important to provide a solid foundation for future growth. The decline on the S&P 500 from the close on Friday, February 21, of 3337.75 through the close on Thursday, February 27, of 2978.76 was about 10.8%. So, we have once again entered into a correction (a decline of 10% or more). As you’ll see in a moment, we tend to get moves like these once a year on average.

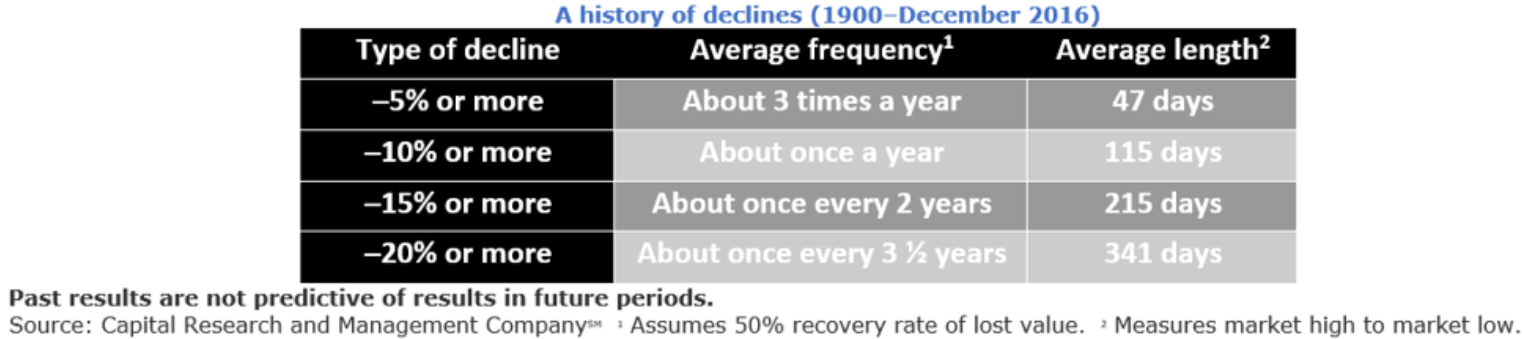

When things get rough for a day, a week, a month or longer, it is always helpful to have a bit of perspective. The following chart is an oldie, but one that I like to trot out every now and then. Capital Research and Management Company did a study of all market declines (using the Dow Jones Industrial Average) from 1900 through 2016. Their research revealed the following:

As you can see, the research suggests that there will be a decline of 5% or more an average of 3 times every year. About once a year, one of those 5% declines will turn into a decline of 10% or more. Further, about half of those 10%+ declines will become a 15%+ decline (in other words, we’ll end up with one of those about once every 2 years). Finally, once every 3.5 years, on average, one of those 15%+ declines will turn into a bear market decline of 20%+. In other words, declines, while scary, are a normal part of long-term investing.

Knowing the above, we regularly counsel that stock exposure is for long-term investments. Funds needed in the near or intermediate term should be in cash, bonds or a similar investment with a lower degree of potential volatility (everyone likes volatility to the upside, it is the downside part that tends to be a bit more worrisome).

Trading

Despite everything that has happened this week, we are still in a secular, or long-term, bull market. While we aren’t there yet, it is entirely possible to have a cyclical bear market (a short-term decline of 20% plus) and still be in a long-term bull market. To that end, we do not currently envision any changes to our longer-term passive portfolio (please note that those who have partaken in our “defensive” passive portfolio had a smoother ride since the defense kicks in automatically, to a point). If/when the indicators suggest that we are no longer in a secular bull, we will re-evaluate the positioning of this part of the portfolio.

For the more opportunistic part of the portfolios, we have yet to make any moves, but we are monitoring things. Typically, markets tend to go down (or up) so far before they reverse. The nature of the reversal and the performance of the constituent pieces of the market may provide some guidance as to what our next moves may be.

We are Here

I had a meeting with a client just a week or so ago – before the recent decline. He confided that he was starting to feel a bit “greedy” and wanted to get more aggressive. His account had done very well and exceeded his expectation; however, since he was not 100% invested in stocks (or US stocks, for that matter), he had not done quite as well as “the market”. We spoke about his longer-term goals and how they might be impacted (or how he might be impacted emotionally) in the event of a significant drop after he acted on his “greed”. We decided not to make any changes. I had a call with that same client this week. Clearly, he was happy with the decision to stand pat.

We spend a lot of time and energy working to align your investments with your goals and your ability to handle the inevitable ups and downs. In fact, the portfolios have an implicit expectation that we will get both the ups and the downs that have normally occurred in the market. That being said, if you find yourself needing a little reassurance, reach out! That’s what we are here for.