Uncharted Territory

It appears that we have entered uncharted territory… 3 letters in 2 weeks!

You probably thought I was going to say that the market is in uncharted territory. Certainly, the moves we have experienced this week are somewhat unprecedented. Swings of 5-10% on any given day are a rare occurrence. To have multiple within one week is simply unheard of. But uncharted territory? I am not so sure.

When I think of uncharted territory, I think back to 9/11. Right now, our markets are still open, but the markets actually closed for a week following 9/11. While it is unknowable, one could imagine that had the markets been open, our recent moves might have paled in comparison to what we would have experienced then. At the time, that felt like it was somewhat uncharted – except for the fact that NYSE also closed during World War I and in March 1933 during the Great Depression. Perhaps uncharted for this generation, but not uncharted.

The speed of the recent decline is somewhat reminiscent of Black Monday. I wrote about Black Monday recently, so I won’t bore you with a repeat. Suffice to say that big drops are not necessarily uncharted territory either.

With the recent moves, we have entered a bear market. Again, not uncharted territory. During the long-term bull market that lasted from 1982-2000, there were a few bear and “almost bear” markets. The most notable, of course, was the 1987 bear, which resulted in a loss in excess of 33% on the S&P 500. The point is that a bear market in the context of a longer-term bull market is normal.

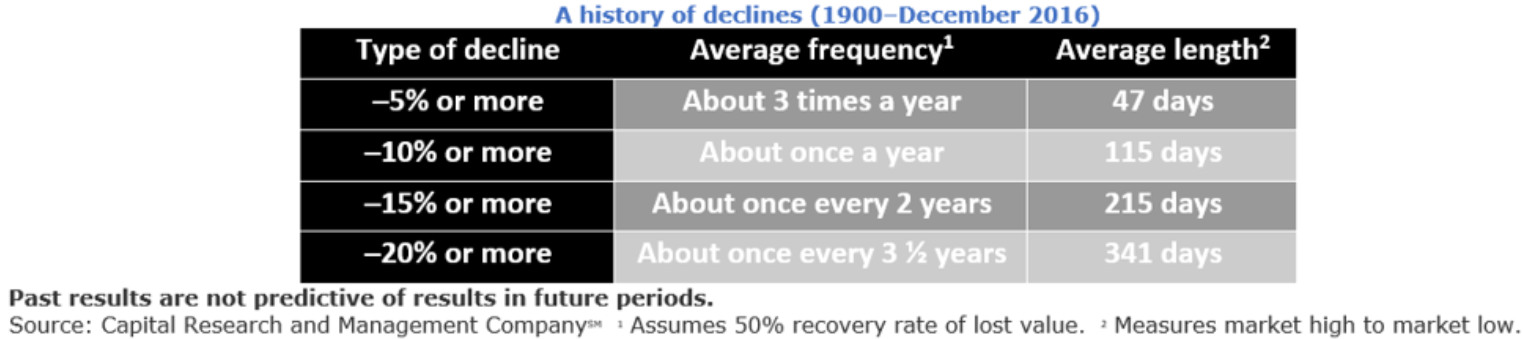

I feel bad about trotting out this chart again, but perspective is important:

Note the last row. A decline of 20% or more happens about once every 3.5 years on average! So, the territory we are in has been well-charted!

The one thing that may be uncharted about our recent experience is our collective reaction to the virus. We are experiencing a cessation of activity that may be unprecedented. Sporting events and the arts have shut down; there are travel restrictions; people are voluntarily distancing themselves from others and Warren Buffett has even made the decision to hold Berkshire Hathaway’s annual meeting online (the cancellation of the Masters or some of the other major sporting events is probably more important to most of you, but this is an investment-related letter).

The ultimate economic impacts are unknown, and the market hates unknowns. Hence the drops we have had.

But, let’s get back to our discussion of “charted” territory. As noted above, bear markets are a normal part of investing. When we structure long-term portfolios, we fully anticipate that they will have to withstand multiple bear markets over time. In fact, as we put together formal plans, we typically stress test the outcomes using Monte Carlo simulations, which essentially run a portfolio through 1,000 different return assumptions – bear markets, bull markets, etc. – to provide an indication of the portfolio’s ability to allow you to achieve your goals.

As if that isn’t enough, you may recall discussions we have had regarding near term cash needs and our emphasis on ensuring that known spending over the next 5 years is held in cash/cash equivalents, bonds or other lower-volatility investments.

The bottom line is this. For us, bear markets are not only “charted” territory, but they are expected and planned for.

Summary of Calls

The last couple weeks have been interesting. With only a couple exceptions, most calls have been from people wanting to add money to their accounts to take advantage of what they perceive to be a buying opportunity. To be fair, there have been a couple calls (only 1 or 2) from people who were beginning to get a bit nervous; however, rather than sounding panicked, they simply wanted some assurance that this time isn’t different.

For the record – while the cause du jour may be different, we do not currently believe that this bear market will be dramatically different than others. In other words, we firmly believe that a recovery and new highs are imminent.

If you have questions or concerns, please call. That is what we are here for.