The Ride Continues

What a ride!

People anticipate a bit of volatility when it comes to investing, but few expect the type of experience we have had of late. We have had 30%+ moves on both the upside and the downside – and that’s just the last six months.

Even the most violent roller coaster eventually levels off, but this ride may have another bump or two to go before we get to that point. Over the next few weeks, we will have to endure a Supreme Court confirmation process, the election and, perhaps, round two of Covid, not to mention the President’s current battle with the virus. All of this will be fodder for market swings; although, there may be light at the end of the tunnel.

Read on…

3Q 2020 Review

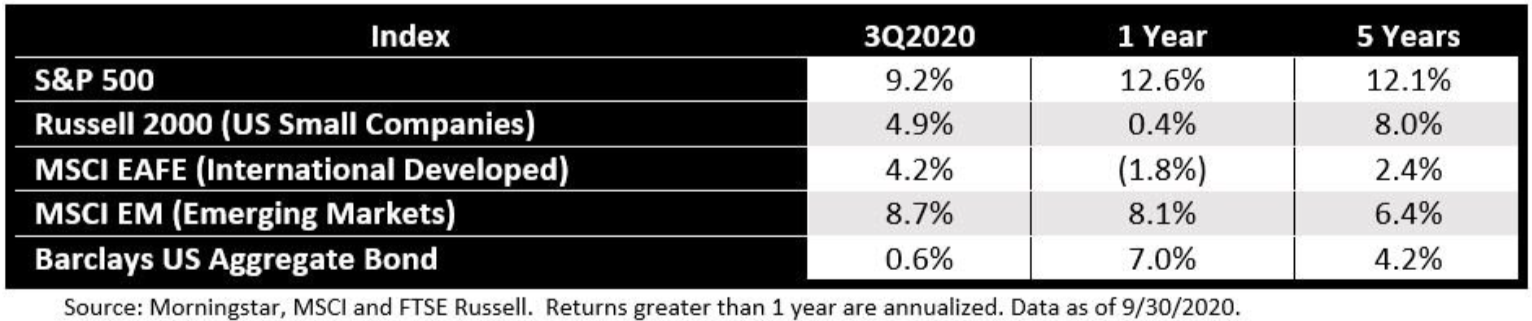

The following chart reflects the performance of a variety of indexes during the last quarter and for longer periods as well.

During the quarter, large US companies, as represented by the S&P 500, clocked the best performance once again. However, companies in the emerging markets were not far behind. While companies in developed markets outside the U.S. were the worst performing stock investments for the quarter, in normal times, most people would be quite pleased with a 3-month return greater than 4%.

As we constantly counsel, investing in the equity of companies (stocks) – whether located domestically or abroad – is a long-term proposition, so longer-term performance is much more important than the daily, monthly, or quarterly zigs and zags. Clearly, large U.S. stocks have led the way for quite some time. Of particular interest is the fact that over the past five years, large U.S. stocks have outperformed large non-U.S. stocks by just under 10% per year.

We mentioned this last quarter, but it is worth mentioning again. Historically, the long-term returns of US stocks and international stocks have tended to reflect a greater degree of parity. The dispersion we are currently seeing has largely persisted since the end of the Great Recession. The question going forward is whether that trend will persist or whether we will begin to see a reversion to the mean, which would suggest outperformance by non-US stocks for an extended period. Time will tell.

For the quarter, bonds had the lowest return, but it was positive. Bonds are an important part of the portfolio as they can provide a little stability during periods of distress. Bond performance over the past year has been fantastic. There are times people would be happy with a 7% return from stocks!

Considerations for the 4th Quarter

As noted above, there are some near-term headwinds that may result in some additional market swings. We will avoid getting into a discussion of our national politics except to say that based on our recent conversations, it seems that people in both parties agree that the last presidential debate was anything but presidential and that our current political situation can best be summed up as dysfunctional.

As of this writing, the markets have digested all the available information and currently, despite the recent declines, do not appear to be overly concerned with the outcome of the election.

While politics makes for interesting discussion at times (and quite frustrating discussion at others), it has less of an impact on the stock market than most people think. Sure, politicians can create headwinds or tailwinds via tax policy, the regulatory environment, etc. However, companies – and people – tend to be fairly creative when necessary.

Tax policy is a great example of that creativity. If taxes become too onerous in one country, large companies are often able to relocate operations, manufacturing, and other functions to countries with more favorable policies. When corporate taxation in the U.S. was significantly higher than that of other countries, companies acted. That is why so many U.S. companies have significant operations – and cash – outside the U.S.

While it is impossible to say what will happen going forward, one only needs to look at the last century to derive some level of comfort.

Over the last century, the U.S. has gone through phases of relatively high and low taxation, high and low inflation, and high and low regulation. Despite the ever-changing political landscape, investors in stocks have been rewarded with spectacular returns. Again, companies can adapt and thrive as long as the rules are clear. We do not expect things to change going forward.

Our Positioning

As we have discussed, our portfolios are effectively split into two components – a long-term “buy and hold” portfolio, which represents about 50% of the total portfolio and a more opportunistic “trading” portfolio, representing the other 50%.

There are two things that make our approach a bit unique. First, for those concerned about the market, our long-term “buy and hold” portfolio can utilize investments that provide a measure of automatic downside protection. In other words, these investments can potentially protect the value of the account during difficult times in the market (although the downside protection may come at the cost of upside participation). For those using them, these investments have proven to be quite useful in dampening the volatility during the tumultuous markets we have experienced this year.

The second thing that makes us unique is our use of both passive and opportunistic approaches. For the opportunistic portion of the portfolio, we work closely with an institutional investment management firm to ensure that we – and by extension, you – have access to the same data and insights relied upon by many of the top investment management firms around the world. This is a data-driven process – we do not let our personal feelings about the market contradict the data. We rely on 6 primary indicators that help derive our top-down decision on how much to allocate to stocks vs. bonds:

Relative Strength: measures whether stocks or bonds are more attractive

Market Breadth: looks at whether many or just a few stocks are improving

OECD Leading Indicator: identifies turning points in business cycles

PMI Breadth: focuses on whether manufacturing activity is expanding or contracting

Baltic Exchange Dry Index: studies shipping rates

Central Bank Policy: examines the activity of central banks around the world with respect to rates and other monetary policy.

Currently, 5 of the six indicators are favoring exposure to stocks with the Market Breadth indicator currently being the only outlier.

Once we have a sense of whether we are favoring stocks or bonds, we then diversify our exposure within each of those broad areas. We diversify among the following areas:

Bond Categories

Cash

High Yield

Long-term US Treasury

Short-Term US Treasury

International Treasury

Investment Grade Corporate

Emerging Market Debt

Stock Categories

Large Cap US

Small Cap US

Technology

Dividend Stocks

International Developed

Emerging Markets

The weighting of each area is a function of its relative strength as compared to the “competitive” investments, with those having greater relative strength getting a larger weighting.

Closing

We are just about a month from the election. Fortunately, that means that the end of the political ad season is near. While we may not know the results of the election immediately, at some point, the outcome will be known, and there will be greater visibility about the future of tax policy, the regulatory environment, etc. There should also be greater visibility with respect to additional treatments and perhaps a vaccine for Covid. Combined, that should provide greater clarity for the market and its participants, which may result in a decrease in volatility as we look to 2021.

In the interim, we are just a phone call away should you need us.