What if [blank] wins?

With only about 2 months to go, people are getting worried. Lately, we have received a few calls and emails from clients worried about the upcoming election, among other things. The conversation usually goes like this:

Client: Do you think we should move to cash?

Lifestyle: Why?

Client: Well, I am concerned that ______ might win the election, and I want to be proactive. Also, there might be…_______ (another wave of Covid, riots, natural disasters, an asteroid hit, etc.).

Importantly, we have received calls from people in both parties about the possibility of the opposing candidate winning. In other words, both feel that if their candidate wins, things will be good and if their candidate loses, things will be bad (an obvious statement since it would be ludicrous to vote for a candidate otherwise).

Our counsel during these calls remains the same – unless you have a piece of information that is not known by anyone at all, your concerns are already known and have been priced into the market. As aptly stated by Andrew Adams of Saut Research:

So, yeah, I don’t enjoy writing about political matters, followed closely by valuation which has its own die-hard proponents and defenders. I will discuss both more in depth below, but my first argument for why they don’t matter nearly as much as some believe they do is simply the fact that I get asked about them so much and so often. If the weekend investors, Seeking Alpha authors, and the dentists and lawyers of the world are aware of something that could impact the financial markets, I guarantee the big money that moves the markets is well aware of it, too. The fact that we have an important election coming up in a couple of months is not a secret; neither is the fact that traditional valuation measures are higher than historical averages. The market knows this and obviously does not care or is more concerned with other things. So why should we waste time worrying about something the market is clearly already discounting?

Of course, there is always the possibility of new data coming to light – new poll numbers, an October surprise, etc. When it does, markets react accordingly – sometimes up, sometimes down. Again, if you are aware of something, the people responsible for managing billions of dollars – if not hundreds of billions – are also aware of it and have positioned their portfolios accordingly, meaning that it is already priced into the market.

In reality, all this worry about things that may or may not happen in the next few months is simply folly. Most of you will not need to access the bulk of your stock market investments for years, if not decades. Remember, we have purposely set aside cash and bonds for nearer term needs. If you are pre-retirement, your long-term investments may not be touched for decades. Even if you are well into retirement, your investments will likely still need to last a couple decades.

So, let’s think back over the last couple decades. In the past, we have reviewed a 30-year period, but for this exercise, we’ll only go back 20 years. Keep in mind that the past 20 years has been a mess (that’s a technical term).

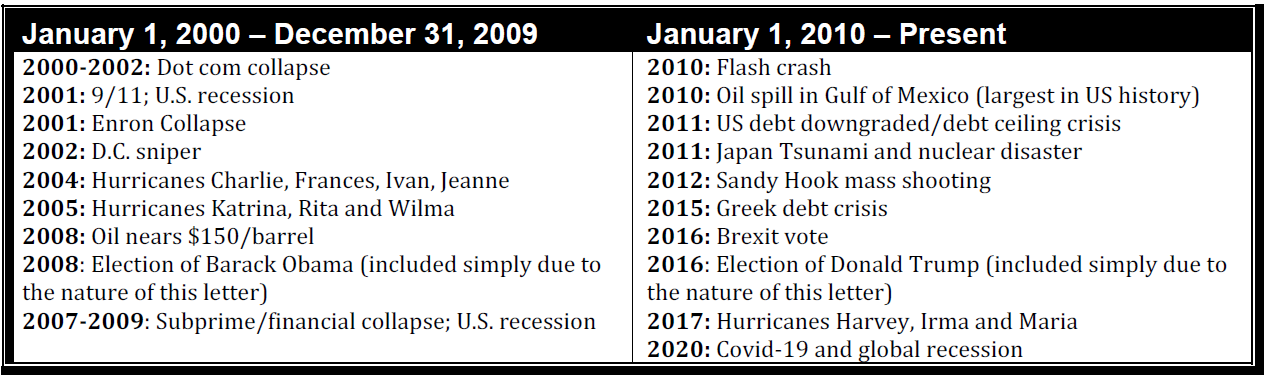

This is just a snapshot of what’s happened since January 1, 2000:

Clearly, there are many important items missing (trade war with China, for example), but hopefully you get the picture – a lot has happened over the last 20 years. During that time, the S&P 500 has gone from to 1,469 when it opened on January 3, 2020 to 3,484 (as of the August 27, 2020 close). So, during a time when we have had two significant bear markets (the dot.com bust and the Great Recession) and a global pandemic, not to mention all the other events, the market is still about 2.4x higher now than it was coming into 2000.

So, the question you should really be asking is whether the short-term noise matters at all. If history is a guide, you would likely be better off focusing on what you can control – your relationships, your career, etc. – and letting your investments do what they were meant to do – grow over the long term.

But What If I Am Still Worried?

If you are still worried, we can certainly help. Our portfolios are typically broken into two components: a long-term, passive portfolio and a more actively managed, momentum-based portfolio.

As we have previously explained, for the long-term, passive portfolio, we can make investments in the various indexes (S&P 500, for example) that can provide a measure of built-in downside protection, a partial "hedge" against negative markets that kicks in automatically – no human intervention. Of course, there is always a quid pro quo. In this case, the additional downside protection typically means that there is not quite the same participation on the upside. Over the long term, however, things may tend to balance out. While only one example, this approach resulted in a smoother ride during the March downturn.

Just to clarify, if this is something of interest, our fees remain constant regardless of the approach (a worry to some).

Wrapping it Up

With about two months to go, there is one thing we can state with certainty – if you are in a contested state, you will be overwhelmed with political advertising. We would also anticipate more swings in the markets as new data comes to light about the political races, Covid and other items. Understand that this is all noise and likely will have very little impact on your results 20 years hence. Of course, if you are concerned, we are here to help.

We look forward to connecting soon.