Opportunity During These "Uncertain" Times

I hope that you, your families, and your associates are in good health.

Have you noticed how people try to dramatize things by constantly referring to “these uncertain times”? Whenever I hear that phrase, I ask myself, “when have times ever been certain?” The only thing that is truly certain is that the future is always uncertain.

Now that I have that off my chest…

Clearly, COVID-19 has had an impact on our economy unlike anything we have ever experienced. While there have been times when the economy has been shut down, it is truly a unique situation when the global economy slams on the brakes for weeks on end.

Health issues aside, there have been job losses for many (unemployment claims approximated 26 million the week of April 20), the real prospect of bankruptcy for countless companies, and, of course, dramatic declines in the stock market.

Fortunately, there are opportunities for those willing to act:

Roth Conversions

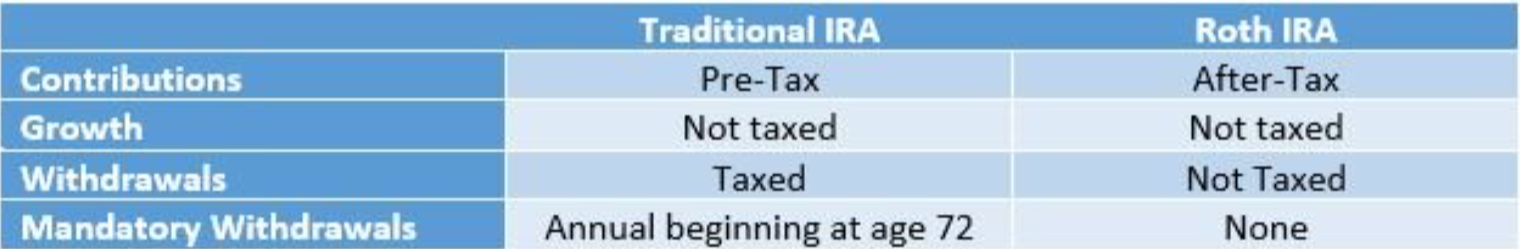

The drop in the market and the overall slowdown in the economy have created an interesting situation for those interested in converting traditional IRAs to Roth IRAs. The following table explains how a traditional IRA and a Roth IRA differ:

What are the potential benefits of doing a conversion?

The reduction in asset values makes a conversion much cheaper today than it would have been only months ago.

We are at historically low tax rates. Given the debt incurred to address COVID-19 needs, there is a high likelihood of tax increases in the future, impacting future withdrawals from traditional IRAs.

The requirement for mandatory withdrawals is not an issue for a Roth IRA.

If funds are needed in the future, they can be taken tax-free by you (or your heirs if the Roth IRA passes to them).

So, what’s the downside? When a conversion is made, taxes are due on the amount converted. For those under 59 ½, taxes should be paid from non-IRA assets to avoid any early withdrawal penalties. Thus, the con is having to pay taxes today rather than at some point in the future. Of course, if tax rates increase in the future, it isn’t much of a “con”.

Charitable Giving

The CARES Act provides two benefits to those that are charitably inclined:

For those giving smaller amounts: Total cash donations up to $300 can be deducted from income without having to itemize.

For those giving larger amounts: Cash donations will be deductible up to 100% of adjusted gross income (up from 60%), subject to certain restrictions.

While both can help charities immensely, the ability to deduct cash donations up to 100% of AGI can prove quite useful to those who are interested in advanced tax reduction planning strategies (if that describes you, let us know).

Long-Term Investing

The drop in stock values has provided an opportunity for long-term investing (5 years+). It is impossible to know whether we have seen the bottom in the current bear cycle. We are treading new ground - nobody alive has ever tried to restart the global economy after months of dormancy. It is a daunting task that will certainly have fits and starts as we try to mend global supply chains, encourage consumers to spend again, and reemploy all those who have been sidelined (some with pay greater than they were receiving from actually working).

But all of that is short-term.

If one looks forward five or more years, the future looks bright. While this extended period of “house arrest” has put a damper on economic activity, think about what’s coming:

Without a doubt, we are at a low with respect to economic activity. As states begin opening, people will begin spending again and that spending should accelerate as people begin to feel more comfortable with the “new normal” (another phrase I despise). Once a vaccine is available, spending should increase dramatically.

The Baby Boomers defined economics in the US for generations, but that is changing. Today, the Boomers number about 69 million and are retiring at a rapid pace (and redefining what retirement means). However, there are two generations, the Millenials (born 1982-1999) and Gen-Z (born 2000-2020) that combined number just under 170 million – over 50% of the US population. Think about what that means for demand as these generations begin building families – housing, clothing, toys, electronics, vehicles, etc.

The current crisis has shown that our ability to create is alive and well. Think about the progress made in finding a cure and a vaccine. Processes that normally take years are being compressed tremendously. If that doesn’t give you a sense of optimism about the future, I am not certain what will.

As noted in our last letter, remote work has advanced tremendously during this period. Think about how quickly we have all become accustomed to video conferencing. These advances can provide companies with cost cutting opportunities and operational flexibility going forward, which can have a positive impact on earnings.

And the list goes on.

The bottom line is that the future looks bright – particularly compared to what we are currently experiencing. Moreover, over longer time periods, the likelihood of losing money in the stock market decreases significantly. In fact, the S&P has not lost money over any 20-year period in its history.

Conclusion

As Sun Tzu said in The Art of War, “In the midst of chaos, there is also opportunity”. We are here to help you explore some of the opportunities being offered during this time of chaos.