Nightmare on Main Street

COVID-19…the story of the day. Some of you are in places that have been deemed “hot spots”. Others are in areas where there may only be a few positive cases. Regardless of where you are, we sincerely hope that you, your families and associates are staying healthy and coping with our near-term reality.

This entire situation makes me think about the movie Nightmare on Elm Street. Our version is more aptly named Nightmare on Main Street. Instead of dealing with Freddy Krueger, we’ve got COVID-19. And instead of avoiding sleep to try to stay safe, we have to avoid one another. It is eye-opening to see how much things have changed in just a few short weeks. When we can return to “normal” (whatever that might be), I, for one, will have a new appreciation for things.

As you know, COVID-19 has resulted in a significant decrease in economic activity. Economists have been arguing of late as to whether we are going to enter a recession or a depression. The arguments remind me of something my grandfather used to say (although, Harry Truman was the originator of the comment):

It’s a recession when my neighbor loses his job; it’s a depression when I lose mine.

We know that for some of you, based on the above, this is a depression. We know others have had to shut down businesses. We also know that some of you are on the proverbial front line – working in hospitals and other essential businesses. For that, we offer a sincere thanks!

So, with all of this going on, is there anything good happening? Let’s see:

In the first time in recent memory, Democrats and Republicans actually worked together to get something accomplished quickly. Sure, there was partisan bickering. But at least something constructive got done (we’ve got to celebrate the little things). For the record, passing the CARES act happened about 8x faster than passing the stimulus act during the Great Recession.

Innovation is happening at the speed of light. The private and public sectors are working together to find cures, vaccines, testing regimens, etc. In just a few weeks, we have identified potential treatments, created efficient testing protocols, developed technology to help extend the life of critical medical supplies, etc. For those who thought our spirit of innovation was waning – look around.

Talking about innovation, how about the ways businesses are changing their business models to cope with the reality of our situation? You’ve probably heard the quote, “necessity is the mother of invention”. You are watching it in real time.

We have made huge strides in the evolution towards remote work and learning. Our new reality has forced us to figure out how to get around many of the obstacles associated with working and learning remotely. While there are still some challenges, the progress that has been made in just a couple weeks is simply astounding.

Speaking of remote, what about the incredible expansion of telemedicine?

We have seen example after example of how kind people can be. From people buying meals for healthcare workers to others buying gift cards to help keep local businesses alive, the examples of generosity are incredible.

So, it is not all bad news. This too shall pass. And when it does, we can continue building on some of these positive trends.

The CARES Act

Given the implications of our situation, the government has decided it is going to do whatever it can to help us avoid an economic catastrophe. Trillions of dollars have been made available via the CARES Act. Among other things, the money provided for in the Act will be used to:

Extend unemployment insurance for an additional 13 weeks (from 26 weeks to 39 weeks in most states). Additionally, benefits will be increased by $600/week for four months.

Send direct payments to individuals of up to $1,200 per adult and $500 per child under the age of 16. Retirees will participate in these payments as well. Like most government programs, however, the benefits decrease based on one’s income.

Make loans to businesses with the amount spent on payroll, rent or utilities converted into grants that will not need to be repaid.

Permit businesses to defer payroll taxes in 2020 until 2021 and 2022.

Allow businesses to claim deductions on current (and past) year losses against past profits to obtain refunds, which can provide a near-term cash infusion.

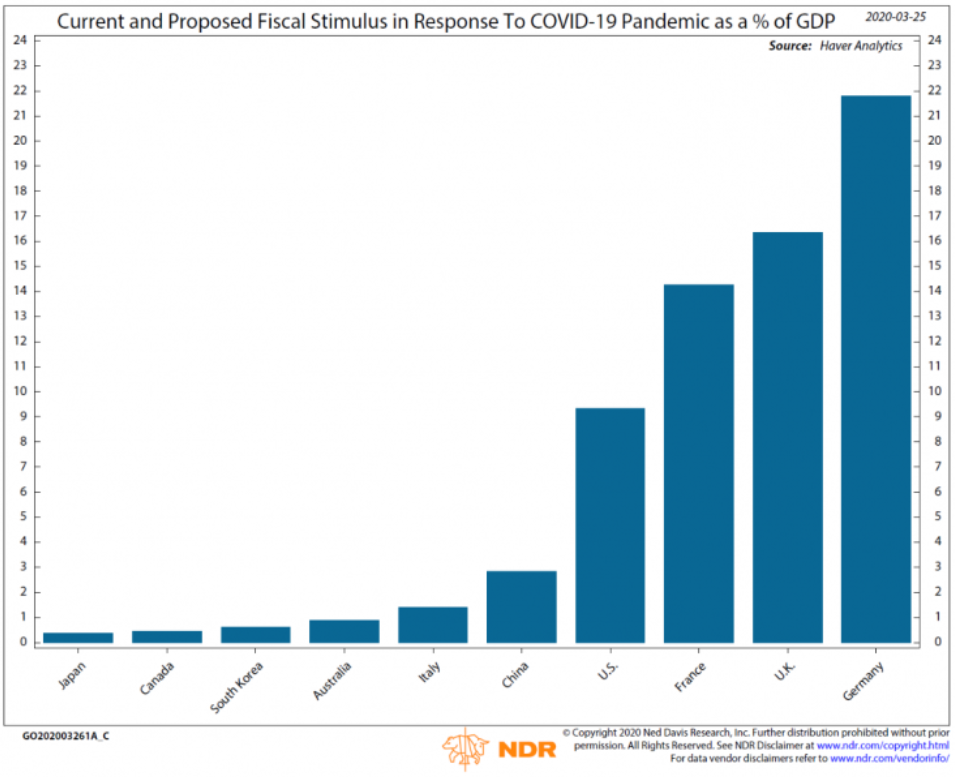

As the chart below shows, the US response as a percent of GDP has not been as aggressive as the response from other nations at this point. Nonetheless, we know that talks are under way to devote additional resources to addressing the crisis.

Combined, countries around the world have devoted 10% of global GDP to backstop the global economy. Again, we expect more to come as governments eventually move from a defensive position to an offensive position and work to stimulate the global economy once again.

1Q 2020 Review

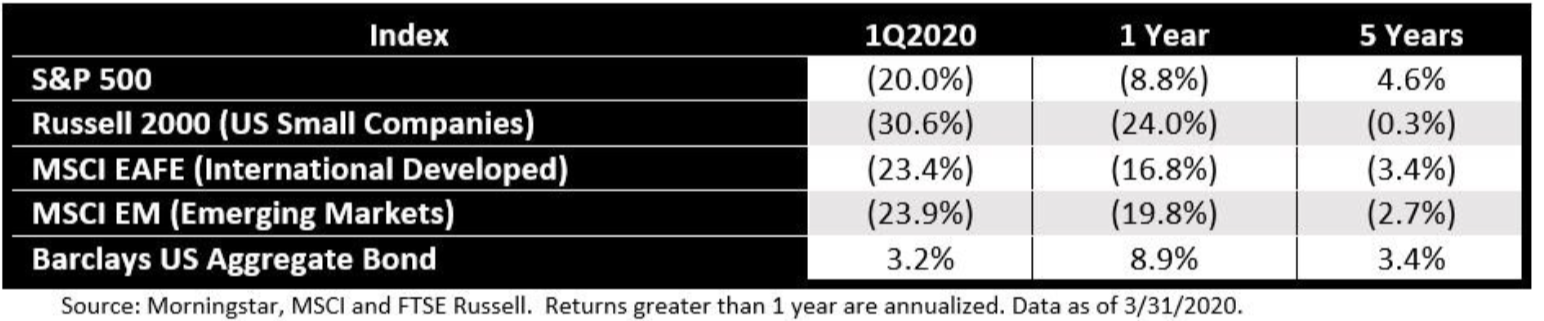

The following chart reflects the performance of a variety of indexes during the last quarter and for longer periods as well.

During the quarter, the best place to invest was in bonds, otherwise, the losses were extreme. Bonds serve as a portfolio stabilizer, which is one of the reasons that we insist on including them in our portfolios. During times like this past quarter, it is nice to have something that can provide some ballast.

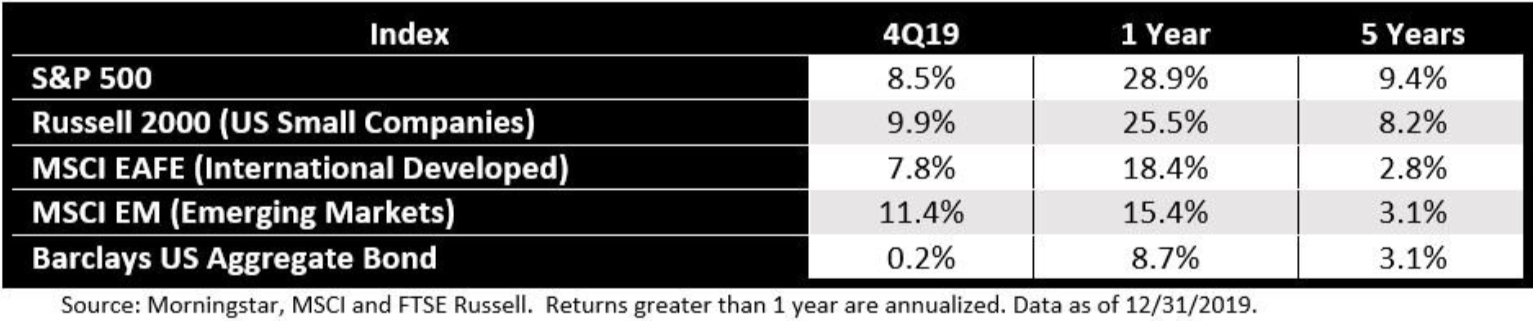

Coming into this year, things seemed great. To refresh your memory, this is what the above chart looked like just 3 months ago:

What a difference a quarter can make! The one-year numbers for everything except bonds turned negative, and the three and five-year numbers for a few of the investments also turned negative. This should reinforce the lesson we discussed last quarter. Namely, simply looking at past performance can be deceiving if you don’t know how to interpret the numbers. It is a mistake that people make quite frequently – chasing past performance in the hopes that the future will be similar. It rarely is.

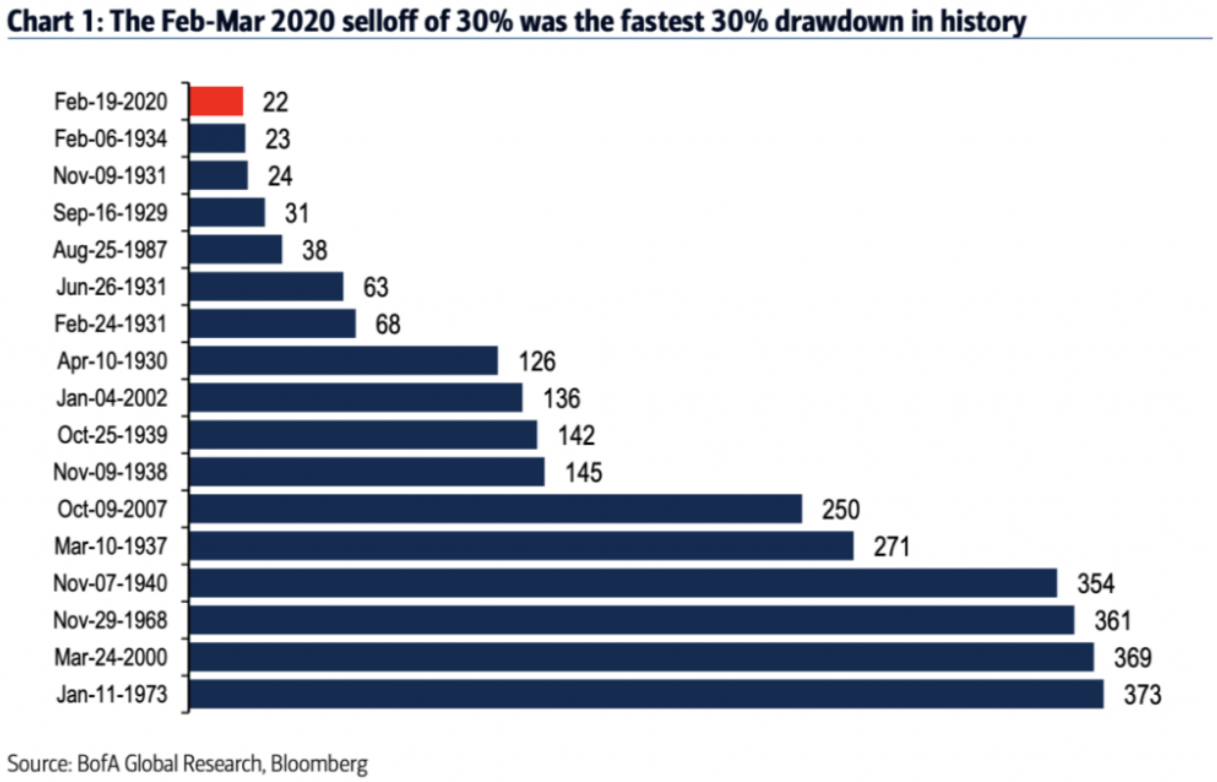

Highs in virtually all stock indexes were hit in early February. COVID-19 and a new oil war caused stocks to drop over 30% from the peak to the recent trough. As shown in the following chart, the 30%+ drop was the fastest decline of that magnitude in history.

Many people are trying to figure out whether we have reached the bottom and should go all-in or whether there is more to come. That’s the question of the day. In a “normal” bear market, there is a big drop followed by a sharp rebound and then a retest of the low hit during the big drop. If the retest fails, the market continues onto the next leg. If the retest is successful, then it is typically a signal that the worst is behind us. To date, we have had a big drop and a sharp rebound. The low has yet to be tested. Again, in a “normal” bear market, it will be. However, this may prove to be abnormal, so we will continue to take things day by day.

The important thing to remember about bear markets is that they do end. More importantly stocks have always hit new highs following a bear market. We certainly do not expect this bear market to be any different. Additionally, the history of health emergencies reveals that they are transitory events. This will end, but since the market is a forecasting tool, you may be surprised to see the market begin rising well before we’ve reached the end of this crisis.

Our “Hedged” Portfolio

We have written in the past about our more conservative stock strategy that provides a degree of downside protection while also providing upside participation. The downside protection is in the form of a “buffer”. If there is a buffer of 9%, for example, at the end of the investment period (1 year), an investor would not participate in the first 9% of losses in the index. So, if the index is down 5%, the investor will be down 0%. If the index is down 10%, the investor will be down 1%. (Note: even though the investment period is 1 year, we can implement trades sooner, if advantageous, but that is a subject for a deeper discussion).

The “cost” of that protection is that the upside is capped. Assume the cap is 13%. If the market is up 12.5%, the investor gets the full 12.5%. If the market is up 14%, the investor stops participating at 13%.

So, there is downside protection and upside participation, but both have limits. As expected, the greater the downside protection, the lower the upside cap.

These “hedged” positions act as additional ballast in portfolios, and we are pleased that during this crisis, the strategy has worked as designed.

Conclusion

If the bear market were the only thing we had to worry about, that would be enough, but we also have our health and that of our families, our businesses, and the list goes on. That’s a lot!

We have spoken with many of you about a variety of issues – investments (of course), whether to fire or furlough employees, how to apply for government assistance under the CARES Act, and the list goes on. If you need some guidance or simply need someone to talk with, we are here. We are fully set up to do online video calls, so let us know how we can help you.

Additionally, if you would like to learn more about our “hedged” portfolios, we would love to provide you with more information.

With any luck, our next quarterly letter will be filled with good news about the growth in the economy and the markets as we all strive to get back to some sense of normalcy. Until then, stay healthy!