“Good Riddance” or “We’ll Miss You”?

Happy New Year!

There are countless reasons that we might want to slam the door on 2020 – lockdowns, masks, business closures, politics, etc. However, from an investing standpoint, the year was actually pretty good – if you could withstand the tremendous volatility. So, should we be happy the year is over or will we look back a year from now and wish it had continued?

Let’s jump to it.

4Q 2020 Review

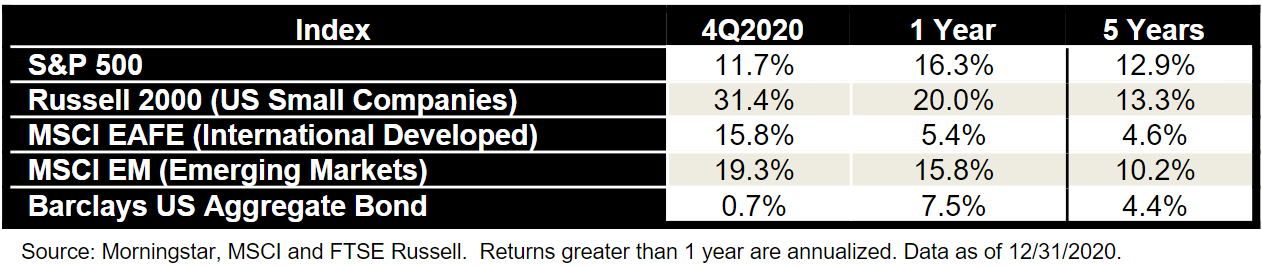

The following chart reflects the performance of a variety of indexes during the last quarter and for longer periods as well.

What a quarter! The major stock indexes shown in the above chart provided double digit returns during the fourth quarter. In a bit of a change, the S&P 500 was actually the laggard with only an 11.7% return for the quarter. The big winner was the Russell 2000, an index of small company stocks, which rocketed ahead by 31% for the quarter and also ended up as the champ for the year with a return of 20%. With this quarter’s return, small company stocks have also taken the cup for the 5-year return.

For most of the last few years, the S&P 500 (large US stocks) has been the story. Put simply, if you invested in the S&P 500, you did very well. If you were prudent and diversified, performance lagged. While one quarter does not make a trend, the performance from this past quarter demonstrates the value of diversification.

Speaking of diversification, what about bonds? The 1-year return from bonds as reflected by the Barclays US Aggregate Bond index pales in comparison to most of the stock indexes with the notable exception being the performance of stocks in developed international markets. However, in most years people would be satisfied with a 7.5% return from stocks much less bonds.

Interestingly, while it is not reflected above, you might be interested to know that the Dow Jones Industrial Average (the “Dow”) had a return of 7.3% for the year. So, in the case of the Dow, bonds actually did outperform stocks.

Bonds remain an important diversifier and have proven their worth during turbulent times. All we have to do is go back to the first quarter of the year. During that quarter, you may recall that stock indexes were down 20-30%. The bond index was up. That’s diversification!

Ch-Ch-Ch-Ch-Changes

The refrain from David Bowie’s song, Changes, seems appropriate these days. A few of the more profound changes of late:

Covid Vaccine: Last January, the term “Covid” was not part of our lexicon. By mid-year, there was nobody left who was unfamiliar with the term. By the end of the year, not just one, but two vaccines had been developed and were being rolled out, with more on the way. The toxic politics aside, what an achievement – and what a change in our collective consciousness!

WFH: A year ago, who knew that Work From Home would be a trend. Today it appears to have staying power and is having widespread impacts.

Brexit: It is here! After a couple votes and years of negotiation, the UK has formally left the European Union.

Blue Ripple: It wasn’t the tidal wave that they expected, but it was enough. The Democrats have taken firm control of the White House and the House. Democrats won both seats in the runoff elections last week, securing a 50/50 split in the Senate, which gives power to the Democrats since the Vice President (Kamala Harris) serves as President of the Senate and can cast the deciding vote in the event of a tie.

Perhaps the most profound change of all, at least for those of us on the West Coast of Florida, was the mark Tampa Bay made on the professional sports world with the Lightning winning the Stanley Cup, the Rays playing in the World Series and the Bucs bringing in Tom Brady to lead the team into the playoffs (and maybe the Super Bowl?).

SECURE Act Part 2?

Last year, we wrote extensively about the Setting Every Community Up for Retirement (SECURE) Act. The SECURE Act was passed in 2019 and was truly bipartisan passing 417-3 in the House and 71-23 in the Senate. As we ended 2020, a bipartisan effort (somehow that still exists) was under way to make even more changes. This effort is currently being called the SECURE Act 2.0, and it is a long way from becoming law, but if/when it does, there are some goodies. As currently contemplated, the Act would:

Raise the required minimum distribution (RMD) starting age to 75 from 72. You may recall that the SECURE Act raised it from 70 ½ to 72.

Exempt individuals with retirement plan balances of $100,000 or less from taking an RMD.

Require new 401k and 403b plans, among others, to automatically enroll employees with a minimum contribution of 3% and annual increases of 1% until the contribution rate is 10%.

Increase catch-up contributions to $10,000 for 401k and 403b participants from the current level of $6,500.

We know that collectively, these provisions can have a big impact on many of you, so we are watching developments closely.

Our Positioning

As we have discussed, our portfolios are effectively split into two components – a long-term “buy and hold” portfolio, which represents about 50% of the total portfolio and a more opportunistic “trading” portfolio, representing the other 50%.

There are two things that make our approach a bit unique. First, for those concerned about the market, our long-term “buy and hold” portfolio can utilize investments that provide a measure of automatic downside protection. In other words, these investments can potentially protect the value of the account during difficult times in the market (although, the downside protection may come at the cost of upside participation). For those using them, these investments have proven to be quite useful in dampening the volatility during the tumultuous markets we have experienced this year.

The second thing that makes us unique is our use of both passive and opportunistic approaches. For the opportunistic portion of the portfolio, we work closely with an institutional investment management firm to ensure that we – and by extension you – have access to the same data and insights relied upon by many of the top investment management firms around the world. This is a data-driven process – we do not let our personal feelings about the market contradict the data. We rely on 6 primary indicators that help derive our top-down decision on how much to allocate to stocks vs. bonds:

Relative Strength: measures whether stocks or bonds are more attractive

Market Breadth: looks at whether many or just a few stocks are improving

OECD Leading Indicator: identifies turning points in business cycles

PMI Breadth: focuses on whether manufacturing activity is expanding or contracting

Baltic Exchange Dry Index: studies shipping rates

Central Bank Policy: examines the activity of central banks around the world with respect to rates and other monetary policy.

Based on the indicators, our opportunistic portfolio began overweighting stocks relative to bonds a few months ago. As we enter 2021, we remain in that posture with small US stocks, technology and international stocks (both developed and emerging) remaining a bit overweight relative to our exposure to the S&P 500 and value-oriented stocks. In other words, we remain overweight the areas that performed well in the 4th quarter, but we are retaining exposure to the other areas as well – just on a relatively reduced level.

Closing

We would love to provide a forecast of what you should expect for 2021, but as 2020 taught us, forecasts should be for entertainment purposes only. What we can say is that a well-diversified portfolio worked very well in 2020, just as it has historically. We would fully anticipate this trend to continue in 2021 and beyond.

We hope you have a happy, healthy, and prosperous 2021. The “happy” and “healthy” parts are in your hands. We will do what we can to assist with the “prosperous” part.

Happy New Year!