Happy New Year!

As we wrap up 2019, it is easy to look at the dysfunction around us and to think things are pretty bad. However, the decade from 2010 – 2019 was perhaps one of the best decades ever.

From the Wall Street Journal (December 16, 2019):

According to the United Nations Development Report, “The gap in basic living standards is narrowing, with an unprecedented number of people in the world escaping poverty, hunger, and disease.”

Extreme poverty fell by more than half from 18.2% to 8.6% (from 2008-2018).

The World Data Lab calculated that for the first time in history, more than half of the world’s population can be considered “middle class.”

People have better access to water, sanitation, health care, and vaccines than ever before.

The incidence of malaria in Africa declined almost 60% from 2007 to 2017, and antiretroviral therapy reduced HIV/AIDS deaths more than half.

The global mortality rate for children under 5 declined from 5.6% in 2008 to 3.9% in 2018.

Death rates from air pollution declined by a fifth worldwide and a quarter in China from 2007-2017.

Rich countries use less aluminum, nickel, copper, steel, stone, cement, sand, wood, paper, fertilizer, water, crop acreage, and fossil fuel every year.

Annual deaths from climate-related disasters declined by one-third between 2000-09 and 2010-15 and represent a 95% reduction since the 1960s.

Despite all the tensions we hear about on the 24/7/365 news, inventors, scientists, and businesses have continued to make great strides. Perhaps the most important New Year’s message is this: things are truly getting better.

4Q19 Review

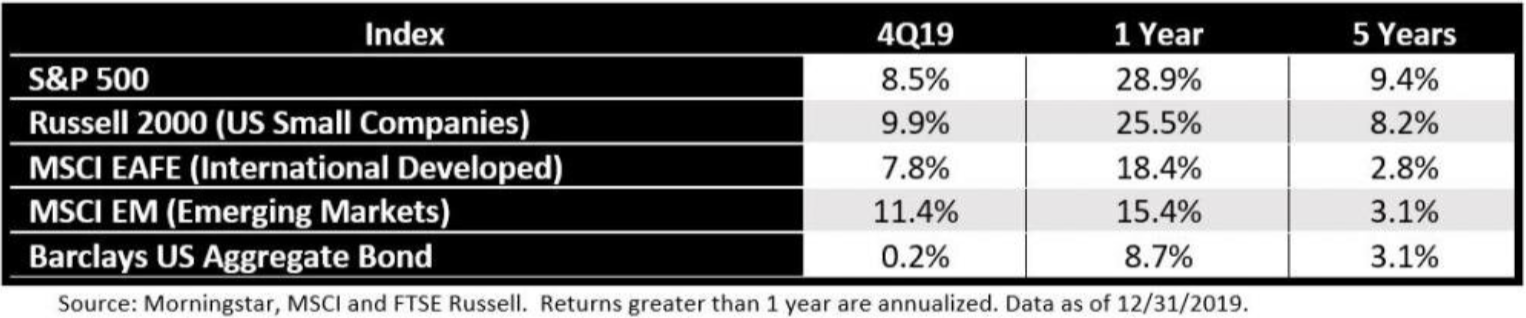

The following chart reflects the performance of a variety of indexes during the last quarter and for longer periods as well.

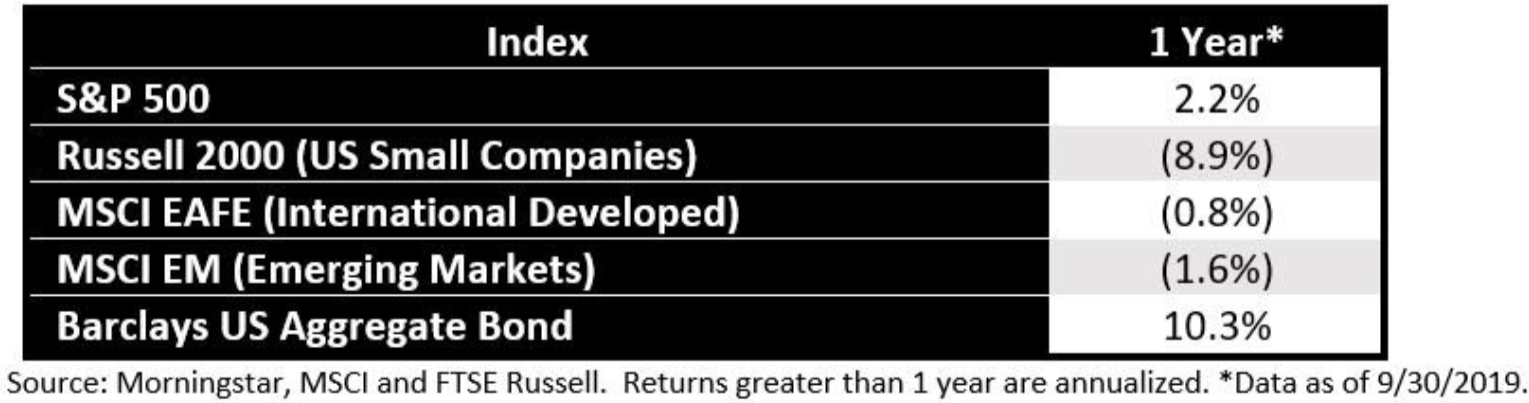

After a dismal third quarter for most of the indexes, the fourth quarter was spectacular. For those that do not remember, after the third quarter, the 1-year performance of the various indexes shown above was as follows:

What a difference a quarter can make! You may be wondering how things can change so dramatically over the course of just 3 months, but remember that the 4th quarter of 2018 was very difficult. Let’s focus on the Russell 2000, which is an index of smaller capitalization companies. The one-year performance of that index following the third quarter was (8.9%). During the 4th quarter of 2018, that index was down 20.2%. Fast forward 3 months and when we calculate the one-year performance, we no longer use the huge negative number from the 4th quarter of 2018. Instead we use the performance during the 4th quarter of 2019 – a whopping 9.9%. Lo and behold, the one-year number jumps to 25.5%. Talk about a big swing!

There is a lesson in this, though. Simply looking at past performance can be deceiving if you don’t know how to interpret the numbers. It is a mistake that people make quite frequently – chasing past performance in the hopes that the future will be similar. It rarely is.

Talking about performance, the long-term difference between the domestic US indexes (the S&P 500 and the Russell 2000) and the international indexes (MSCI, EAFE, and MSCI EM) is worth noting. Most people would look at the numbers and increase their allocation to the US indexes. The reality is that over extended periods, there is much more parity in the performance numbers, so those that believe in reversion to the mean would be more inclined to add international exposure at the expense of domestic exposure. Time will tell.

The SECURE Act

In what seems to be an increasingly rare act of bipartisanship, Congress passed the SECURE Act (the “Act”), which went into effect on January 1, 2020.

There are many interesting components of the Act, but for the purposes of this letter, we are going to focus on a couple that are most pertinent to many of you.

RMD Changes: For those of you who did not reach the milestone age of 70½ by December 31, the Act will let you delay taking required minimum distributions from your retirement accounts (IRA, 401k, etc.) until you turn 72. Unfortunately for those who have already been taking their RMDs, there is no relief for you.

Stretch IRA Gone: A popular estate planning technique for those with very large IRAs has been the “stretch IRA.” This technique allowed a person to bequeath their IRA to a non-spouse who would then be able to take withdrawals over the span of their lives, which could be decades for a young heir. The Act has changed this with the requirement that, barring a couple specific exceptions, all non-spouse beneficiaries withdraw the funds within 10 years. Since withdrawals are taxed, this can have a tremendous impact on the tax rates for younger heirs. Imagine, for example, an IRA worth $1 million going to a 35-year old with a life expectancy of 85 (for simplicity). Under the old rules, the 35-year old would have 50 years to withdraw the funds and would take $20,000/year. Under the new rules, the funds need to be depleted within 10 years, suggesting an annual withdrawal of $100,000/year. Quite a difference.

If you think you’ll be impacted by the change in the Stretch IRA rules, let’s talk. There are strategies that we may be able to employ that will allow you to convert your existing IRA to a Roth IRA without paying all the taxes that you would normally have to pay. These approaches can be a benefit to both you and your heirs.

Conclusion

As we look forward to 2020, the one thing we can say with some degree of certainty is that it should be an interesting year given the election, ongoing impeachment battles, etc. Looking back at 2019, the markets seemed to shrug off that “noise” and focus on the economy and corporate earnings, which is where the focus should be. Nonetheless, headlines tend to result in market moves – both positive and negative (just look back at the last couple quarters).

Our team will be reaching out over the next few weeks to check in and make sure that we are addressing your needs and concerns as we focus on 2020. If you need something prior to that, you know that we are always eager to help.

Happy New Year!